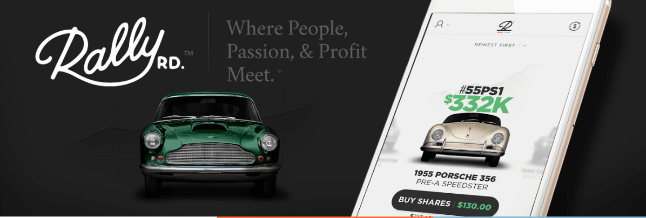

It’s easier to own a Ferrari with Rally Rd. Rally Rd. is a start up that aims to democratize classic car collecting by turning premium vehicles ( such as a $165,000 vintage Ferrari Testarossa or a $425,000 Porsche Speedster ) into stock.

Christopher Bruno, the co-founder and CEO of the start up says that each of the investment on Rally Rd. is essentially a mini public company, and adds that their investors have become able enough to create a custom, diversified portfolio of equity interest in blue-chip collector cars, share by share.

After the start-ups’ team of experts identifies some investment opportunity, the company acquires the car and securitizes that opportunity, turning it into the equity shares. Price per share gets determined by the value of the car divided by 2000. Then, investors are able to purchase stock in the vehicle for as low as $50 each share. Rally Rd. The start-up does not charge any commissions or management fees, and the entire process is completed on a smartphone, through the mobile app of company.

Always, the cars on Rally Rd. are for sale. The start-up decides the time to sell a car with the help of input from an expert advisory board, and investor sentiment, determined by data collected on the application.

Must Read: Uber BOAT starts serving the people in Middle East

After the sale if a car, the proceeds get paid to shareholders of it. In case the investors want to exit before an asset is liquidated, they could trade their shares on a secondary market during a monthly trading windows.

According to Bruno, the app launched over Thanksgiving weekend to a waitlist of almost 20,000 people, many of whom are the millennials.

Currently start-ups’ SEC-regulated securities are for sale through a registered broker-dealer licensed in 32 U.S. states.

The start-up is making money as the underwriter of each initial transaction, just as some investment bank makes money when it takes a company public. Rally Rd. is exploring some additional revenue streams, with inclusion of subscription services that sell premium products and experiences to the investors on the platform.

Bruno says that merchandise experiences all the built around people enjoying the cars and the collection are the ways that we assist to make money for us (but also that can drive dividends for the very investors in the actual cars).

“The last 10 years have been very, very good for the asset class,” said Bruno. Adding that “Hopefully there’s a lot more room to go.”