In order to restore dangerously low stocks of foreign currency, Pakistan plans to borrow more than $4 billion from the Saudi-backed Islamic Development Bank (IDB).

According to officials of the Jeddah-based bank, they have agreed to make a formal offer to lend Islamabad the money when Imran Khan takes over as prime minister.

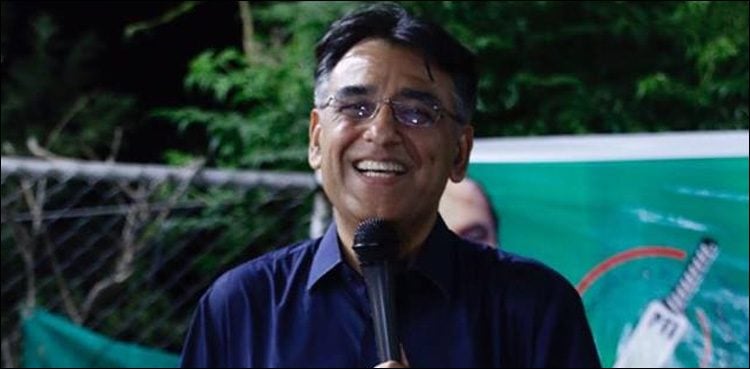

Moreover, they expect Asad Umar (Khan’s proposed finance minister) to accept the proposal. One senior adviser in Islamabad claimed that “The paperwork is all in place. The IDB is waiting for the elected government to take charge before giving their approval.”

Since the loan would not cover Pakistan’s estimated financing gap which is at least $25 billion during this financial year. However, the advisor aware of Pakistan’s situation said that would be “an important contribution”.

On the other hand, Imran Khan (Pakistan’s former cricket captain), is expected to take over as prime minister on 15th August.

After taking the oath, one of his first jobs will be to fix the country’s balance of payments crisis, with high imports and sluggish exports having bled the country of much of its foreign exchange reserves.

Must Rea: Apple faces music over its faulty “speaker” output!

Asad Umar, who served as the PTI’s shadow finance minister said in a statement that, “The situation is dire. We’ve got $10 billion dollars of central bank reserves, we’ve got somewhere between $8 billion and $9 billion in short-term liabilities, and therefore your net reserves are close to nothing.”

On the other hand, the plan is already drawn up by officials to borrow up to $12 billion from the International Monetary Fund. However, this aid is expected to come with strings attached, like a demand to see the details behind billions of dollars’ worth of Chinese loans.

According to Officials, this loan would be used mostly to pay for oil imports, with higher crude prices have contributed to Pakistan’s problems. While Umar is looking at what other options remain open to him, of which the IDB loan is one.

However, Khan’s new government will still have to perform potentially unpopular spending cuts and tax rises to lend a hand in repairing the government’s balance sheet.

“The budget deficit shot up to about 7 percent of the gross domestic product during the last financial year,” Waqar Masood Khan, a former finance ministry official said. “Bringing that down to the target of 4 percent is not going to be easy.” He added.

Although the offer by IDB is a positive sign by Saudis, Pakistan has to see that this aid should come without any terms and conditions unlike the previous record of foreign aids.